Financial Capability Matters

What’s it like to be an earning, bill-paying adult for the day?

JA Finance Park is an innovation in experiential education designed to engage middle school students for life and work in the real world.

And that means learning and practicing how to make informed decisions for lifelong success by:

Aligning the realities of life – and personal choices – with financial stability

Connecting education and career decisions with income expectations

Experiencing first-hand what it takes to make it

JA Finance Park is a public/private nonprofit collaboration between our region’s school systems, businesses, educators and volunteer mentors who come together to inspire, guide and teach students how to be financially capable and ready to take on their futures. From goal-setting to saving, budgeting, shopping and bill paying, students experience what it really takes to successfully navigate today’s complex economy and they come face-to-face with how their decisions today can impact their future.

JA Finance Park combines classroom curriculum taught by teachers with a high-impact simulation. This knowledge serves as a foundation in personal finance education and gives young people the skills they need to be successful and support them in their lifelong journey.

the teacher-led CURRICULUM

The JA Finance Park Virtual curriculum features interactive lessons on Income, Savings, Investing, Risk Management, Debit, Credit and Budget. Financial concepts are brought to life in videos recorded by volunteers from our local business community

INCOME

Students recognize the role of financial institutions and the various services they provide. Through case studies, games, graphing, and other group activities, students understand the advantages of saving, investing, and using credit wisely.

SAVING, INVESTING, AND RISK MANAGEMENT

Students explore saving and compare investments as a part of their overall financial planning. They also examine risk and how insurance may help protect savings.

DEBIT AND CREDIT

Students compare financial institutions and their services. Through discussion and a game activity, they also weigh the advantages and disadvantages of debit and credit. Lastly, students examine the role of credit scores and credit reporting have on personal finances.

BUDGET

Students discover the importance of spending money wisely and recognize a budget as a valuable tool. They create personal budgets based on saving and lifestyle goals and day-to-day situations.

The facility-based simulation

View Finance Park Locations>>

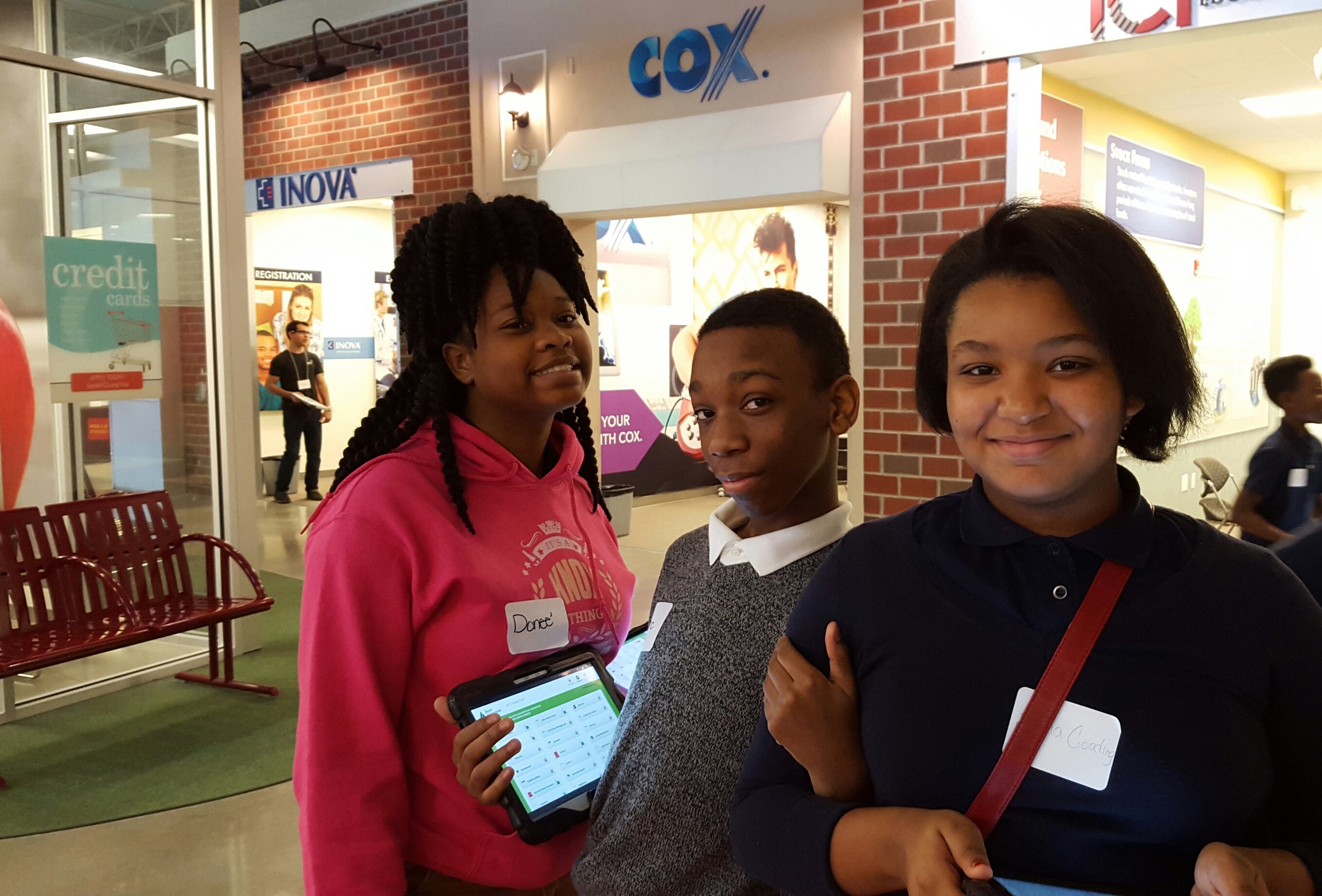

JA Finance Parks are mini-cities with working storefronts that are supported by committed business leaders and trained volunteer mentors.

Students' experience culminates at a JA Finance Park facility, where students have the opportunity to put their newly-learned skills to the test in this digital, 21st century, innovative learning environment. The "mini-city" houses a variety of storefronts and kiosks, correlating to the personal budget lines each student must manage during their JA Finance Park visit.

As these young people enter the doors of Finance Park, they leave behind their lives as middle school students and take on a life scenario: an avatar with a career, salary, credit score, debt, a family, and financial obligations.

On tablet computers, students make their way through various phases of the day:

Set Up & Savings

During the first phase of the day after an initial welcome, students watch a career presentation and answer lifestyle questions about their hopes for their financial futures. Volunteers lead small group discussions on students' assigned life scenarios, including income, job title and educational background, marital status, if they have children, existing savings and debt, and credit score. Students calculate their net monthly income and learn about setting a monthly savings goal. Students then allocate that savings to three saving funds.

Research

During the Research phase, in small groups, students visit each storefront and kiosk at JA Finance Park and engage in a discussion with volunteer role models on the various budget items contained within JA Finance Park. Utilizing provided discussion questions, volunteers initiate group discussion with students about their research discoveries and share personal experiences and suggestions about budgeting.

BUDGET

During the JA Finance Park Budget phase, students build a monthly budget on their tablet computers, informed by their research and volunteer-led discussion. They allocate 100% of their household net monthly income during this phase and record their financial plan in the software.

Shopping

Students make shopping selections in their home storefront, getting a better understanding of what their personal tastes and preferences actually cost. As they choose a home, clothes, furniture, car, and other purchases, they discover how close they came to budgeting accurately, based on their wants and needs. Students may spend more than they budgeted, but are forced to account for any budgeting discrepancies by spending less in another area.

Payment & Checkout

During the Payment & Checkout phase of the JA Finance Park experience, students pay for all their shopping selections, using a debit card or by making an online payment from their banking account.

Guided by adult volunteer mentors, the simulation helps students grasp the implications of their "financial decisions" as they work towards a balanced budget by the end of their visit, and allows these young people to experience the challenges of making real-life financial decisions that will lay the foundation for how they approach their financial responsibilities in the future.